Explore the best loan apps in Nigeria in 2025. Compare OKash, Branch, Palmcredit, Renmoney & others by interest, speed, safety, and features. Borrow smartly.

As digital finance continues to reshape how Nigerians access money, mobile loan apps have become increasingly popular. Whether you need a small emergency loan, funds for business, or just flexibility, there are many apps now competing for your attention. But which ones are safe, fast, and reasonable? Here’s a curated list of trusted loan apps in Nigeria in 2025, what they offer, and how to choose the right one for you.

What to Look For in a Loan App

Before reviewing specific apps, it helps to know what features matter most. A good loan app should have the following services:

- Speedy loan approval

- Transparent fees and interest rates

- Flexible repayment terms

- Customer-friendly terms (clear about what happens if you default, complaints etc.)

- Strong security/privacy

- Good reputation/reviews

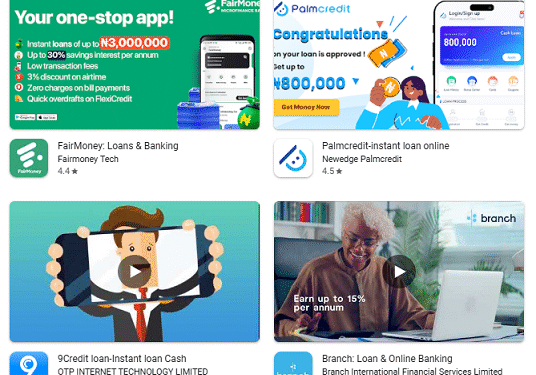

Top Loan Apps in Nigeria (2025)

Here are loan applications that are popular and credible as of 2025:

Advertisement

| App | Key Features | What Makes It Stand Out / Cautions |

|---|---|---|

| OKash | Loans up to ₦1,000,000, fast approval, paperless application. | Great for urgent cash; but be very sure you understand repayment timing and fees. OKash allows cancellation within 24 hours. |

| Branch | Digital finance platform — instant loans, bill payments, transfers. 100+ million downloads across markets. | Reliable brand; often more trust. Higher amounts may require more documentation or verification. |

| Palmcredit | Offers quick loans (₦2,500 to ₦100,000), with flexible repayment (12–26 weeks), low interest (starting around ~8%) for some users. | Ideal for small-to-medium urgent loans. Larger amounts might need good repayment history. |

Other Loan Apps to Watch

Besides the three above, here are more apps that many Nigerians are using in 2025. Always read full terms before you commit.

- FairMoney

- Alend

- Easemoni

- Legend Cash

- Jaramoni

- Frimoni

- Renmoney

- CreditDirect NG

- FlashLend / LoanPlus / ZazzaLoan

These apps vary in maximum loan amounts, interest rates, speed, verification processes, and fees. Some require BVN (Bank Verification Number), proof of address, or a savings history. Others are lighter on documentation but may charge more.

Comparing Individual and Business Loans

Although loan apps are mostly used by individuals, your needs can differ greatly depending on whether you’re borrowing casually (individual) or for business reasons. Here are a few differences:

| Factor | If Using it Personally | If Using it for Business |

|---|---|---|

| Loan size required | Often smaller; just enough to cover expenses or emergencies | Likely larger; might need recurring funding, stock, supplies, salaries |

| Repayment flexibility | Important—you don’t want penalty fees or daily deductions that stress you | Need predictable repayment schedule; cash flow matters |

| Cost of borrowing (interest + fees) | You may accept slightly higher fees if speed matters | Lower fees more important; you’ll want transparent terms to avoid surprises |

| App features you value | Ease of use; simple sign-up; fast disbursement | Features like multiple loans, loyalty or credit line increases, good customer service & disputes handling |

Tips for Using Loan Apps Safely

- Check the interest: What is the interest rate? Is it flat or reducing? What are late/penalty fees?

- Check app permissions: Some apps ask for many permissions on your phone; only grant what makes sense.

- Verify legitimacy: Check reviews, see if they’re registered (where required), and whether others report issues.

- Plan repayment: Borrow only what you know you can pay back. Hidden fees or unexpected charges can balloon debts.

- Use trusted channels: Download apps from official stores (Google Play, App Store) and verify web pages when applying online.

What’s Different in 2025

- Higher competition among loan apps means better terms in many cases: some apps now offer lower interest, more flexible repayment, and faster approvals than just a year or two ago.

- Regulation is tighter, which is good: more apps now require BVN and are under FINCON (Nigeria’s financial regulatory oversight), which tends to enforce more consumer protection.

- User trust is becoming a differentiator: apps that are transparent, timely in disbursements, and clear about fees are winning over users.

Conclusion

The loan app market in Nigeria in 2025 has many good options, from OKash, Branch, and Palmcredit, to several others. The best app for you depends on how much you need, how fast you need it, and how you plan to repay.

Always treat loans seriously: while they can solve emergencies, small miscalculations can lead to stress. If you pick an app with fair fees, clear terms, and reliable service, these tools can serve you well.